Indexed Universal Life and Annuities Insurance! How

thrilling they can be!!!

Building a Strong Financial Foundation, is an important start in securing your family legacy and life style.

This wealth strategy, separates the 10% from the 90%

- Shawn Sumner

Life Agent

About Us

We've Been Thriving

We’ve been blessed to help over 90,000 families with life insurance and retirement plans. We would love to help you accomplish all of your goals. We believe when you’re planning your life there's alot to consider, from known to unknown, and we would love the opportunity to support you. In life everything falls into three categories - what we know, what we know we don’t know, and what we don’t know we don’t know. We’re here to verify what you know is accurate, and help you with the unknowns.

Our History

Over the two last decades we’ve serviced families from all walks of life all over the United States of America. We believe every individual should get world class treatment.

Our Mission

Our mission is to see that every family gets a first class financial education. We want you, your kids, your grandkids, and all generations to come to experience what generational wealth is.

Who We Are

We are a financial marketing organization that has partnerships with the oldest and strongest A rated life insurance and retirement providers to ensure we can find the best fit for you and your family.

Your Benefits, and the A+ RATED CARRIERS I WORK WITH

Why Choose Us

There are many companies that can sell products, and we are not one of them. We don’t sell to sell, we sell to solve a problem. Our goal is to educate all of our clients so that they can understand what their needs are, what solutions are available, and how all the plans work. We believe if someone knows what's best for them, they will be able to choose what's best.

We Respect You

We will treat you as an individual and part of our family versus a mass group of people.

Doing What's Best For You & Your Family

We will create a custom plan that fits your needs and your budget.

World Class Service.

So many companies have lost appreciation for their clients and no longer provide great customer care.

Get Our Free 5-Step Video Training Series Financial Plan.

Ready to learn how to be prepared for your financial future? Submit the form to receive a completely free 5-Step video training series that will teach you:

Video #1: The 4 Factors Of Retirement

Video #2: The Rule Of 72 & The Three Homes Of Money

Video #3: Why You Need Life Insurance With Living Benefits

Video #4: The Rule of 100 & Retirement Planning

Video #5: The Power Of Tax Advantage Accounts

By submitting, I agree to the privacy policy & terms provided. I agree to receive sms and email messages from the business. You may reply 'stop' to opt out at any time.

Our Feedback

What Clients Say

Wanda Says -

“After 14 years of recommendations, I still have my money protected - so somebody did something right with me! I totally believe in you guys and I’m so glad that I have been involved all these years. You are truly a friend that loves me and has my best interest in mind”

Brandon Says -

“I have had the pleasure of working with then, and I can confidently say they are an absolute professional and genuine person. Their extensive knowledge and ability to navigate through my questions and concerns and explain technical information with ease gave me the confidence to choose the right products for me and my family. The authenticity as a person and an advisor/agent makes them a standout individual in their field. Working with them was a privilege and such a positive and enriching experience. I would recommend them as an insurance and financial services provider to everyone I know and love. They are simply the best!.”

Leila Says -

“I’ve known them for several years. I wanted to have an insurance policy that not only covered myself in case of death but also allowed the money I paid into the policy to grow, as an annuity. They were very helpful in explaining the differences in policies and looking at my income to best suggest the proper policy for me. The policy that I finally chose was a very good balance between benefits and cost. What I did not know was that some time later, I would develop Ovarian Cancer. Fortunately, because of their work on suggesting the right policy for me, I was able to receive a small settlement. I would highly recommend them for any insurance/financial planning for single person or family. Take it from someone who had one of the worst life experiences you can imagine, and still came out on top!”

Our Solutions

We have a suite of products to fit your individual and unique needs.

Life Insurance

• Indexed Universal Life

• Universal, Whole & Term Life

• Long Term Care & Disability

• Final Expense & Living Benefits

Retirement Planning

• Indexed Annuity

• Fixed Annuity

• IRAs / SEP IRA

• 403(b)/ 401(k) Rollovers

Other Solutions

• Mortgage Protection, Term Insurance

• College Savings Plans

• Business Owner Solutions

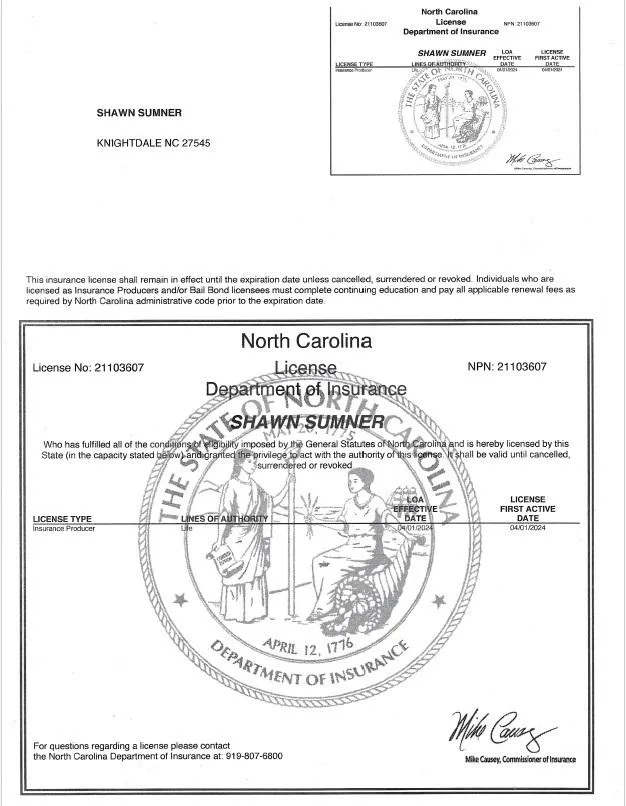

State Licensed & Verified

I'm fully equipped & trained to provide professional financial services in the residential state of North Carolina

Additional State Licenses In:

NC, NY, MI and VA

Frequently Asked Question

What’s the right time of insurance for me?

That will depend on how you want the policy to work, your insurable need, and your budget/savings allowance.

Can my insurance policy build savings?

Yes, cash value policy’s have the ability to build a savings account.

Can I borrow against the savings?

Yes, there are different options for pulling out money. Some allow you to borrow against the policy through a loan which can avoid taxes.

What different companies do you work with?

As a broker, we look for the top rated insurance and retirement planning companies; that will provide clients the best products.

Is there a cost for this?

We do not charge any financial review fees and do not mark up any products. We are compensated directly from the insurance company that best suits your needs. This all allows us to do the best thing for the client and not charge them for it.

How do I get started?

Fill out and submit the form above, to get a complementary review personalized analysis on your finances and receive our free 5 step by step training video series.

Learn why PHP is leading in the life insurance industry, learn about sales, becoming an entrepreneur, and what having the right platform, can do for your business.

Earn an extra $2000 to $3000 a month part-time!!

Office:

401 Harrison Oaks Blvd, Cary NC

Call

984-206-3646

Email: